| | | | | | | | | | |

| | | | | | | | | | | |

2016 PROXY STATEMENT | | | | VORNADO REALTY TRUST | | | | 57 | | |

| | | | | | | | | | | |

PROPOSAL 3: APPROVAL OF AN AMENDMENT TO THE COMPANY'S DECLARATION OF TRUST TO ELIMINATE THE CLASSIFICATION OF THE COMPANY'S BOARD OF TRUSTEES

Section 2.2 of the Company's Declaration of Trust (the "Declaration") provides for the classification of the Company's Board into three classes, with the Trustees of one class being elected every year to serve until the third succeeding annual meeting and until their successors are duly elected and qualify. In March 2016, the Board deemed advisable and approved an amendment to the Declaration that would eliminate the classification of the Board over a three-year period (the "Amendment") and directed that the Amendment be submitted for consideration and to be voted upon by the Company's shareholders at this annual meeting. The text of the Amendment is attached as Annex B to this Proxy Statement.

In advance of this annual meeting, the Corporate Governance and Nominating Committee of the Board (comprised entirely of independent Trustees) as well as the full Board reviewed and reconsidered the arguments both for and against a classified board of trustees, many of which have been set forth in previous proxy statements in connection with non-binding shareholder declassification proposals, as well as other factors, including the results of the votes upon such shareholder proposals. In addition, we engaged in an extensive shareholder outreach effort to discuss governance matters, including our Board classification. Arguments for eliminating the classification of a board of trustees include that it could have the effect of increasing trustee accountability, it would give shareholders the opportunity to express their views on the performance of each trustee annually, it is responsive to our shareholders and the annual election of directors has become the norm for S&P 500 companies. Arguments against eliminating the classification of a board of trustees include that classified three-year terms for trustees can be consistent with and supportive of a company's long-term business and investment strategy and that a classified board structure can help to safeguard against coercive attempts to acquire control over a company. After careful consideration, the Corporate Governance and Nominating Committee recommended to the Board that, although there continue to be strong arguments in favor of continuing a classified board, it was advisable to amend the Declaration to eliminate the classification of the Board. The Board considered carefully the recommendation of the Corporate Governance and Nominating Committee as well as the reasons for that recommendation and determined that it was advisable to amend the Declaration to eliminate the classification of the Board.

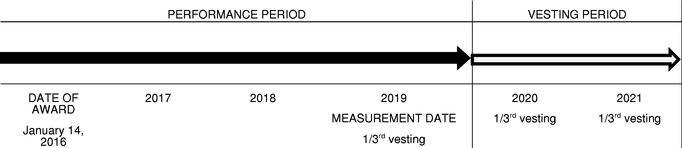

If the Amendment is approved by the Company's shareholders, then the Company will file Articles of Amendment to the Declaration containing the amendment text set forth in Annex B to this Proxy Statement with the State Department of Assessments and Taxation of Maryland. The Amendment provides that the Trustees elected at this annual meeting will serve until the 2019 annual meeting of shareholders, the Trustees elected at the 2017 annual meeting of shareholders will serve until the 2018 annual meeting of shareholders, the Trustees elected at the 2018 annual meeting of shareholders will serve until the 2019 annual meeting of shareholders and beginning with the 2019 annual meeting of shareholders, all trustees will be elected to serve until the next annual meeting of shareholders and until their respective successors are duly elected and qualify. Accordingly, if the Amendment is approved by the Company's shareholders, then at the Company's 2019 annual meeting of shareholders, the transition to a declassified Board would be complete and, at the annual meeting of shareholders held in 2019, the entire Board would be elected to serve until the next annual meeting of shareholders and until their respective successors are duly elected and qualify.

The Board of Trustees recommends that you vote "FOR" the approval of the amendment to the Company's Declaration to eliminate the classification of the Board of Trustees.

Vote Required

The affirmative vote of shareholders of not less than a majority of the Shares outstanding and entitled to vote on this proposal, assuming a quorum is present, is required to approve the Amendment. Abstentions and broker non-votes will not be counted as votes cast and will have the effect of a vote against the Amendment.

If the Amendment is approved by the shareholders, it will become effective upon the acceptance for recording of the Articles of Amendment by the State Department of Assessments and Taxation of Maryland, which we would expect to occur promptly after the Annual Meeting. If the Amendment is not approved by the shareholders, Section 2.2 of the Declaration will remain as currently in effect and the classification of the Board will not be eliminated.

| | | | | | | | | | |

| | | | | | | | | | |

| | 58 | | | | VORNADO REALTY TRUST | | | | 2016 PROXY STATEMENT |

| | | | | | | | 75 | | |

PROPOSAL 4:3: NON-BINDING, ADVISORY RESOLUTION ON EXECUTIVE COMPENSATION The Compensation Discussion and Analysis section appearing earlier in this proxy statement describes our executive compensation program and the compensation decisions made by the Compensation Committee in or for 20152022 with respect to our Chief Executive Officer and other officers named in the Summary Compensation Table (whom we refer to as the "Named“Named Executive Officers"Officers”). In accordance with the rules and regulations of the SEC, the Board of Trustees is asking shareholders to cast avote for the following non-binding, advisory vote on the following resolution:

Advisory Resolution on Executive Compensation

Resolved:

Proposal: That the shareholders of Vornado Realty Trust (the "Company"“Company”) approve, by a non-binding, advisory resolution, the compensation of the Company'sCompany’s executive officers named in the Summary Compensation Table, as disclosed in the proxy statement for this Annual Meeting pursuant to the compensation disclosure rules of the Securities and Exchange Commission (which disclosure includes the Compensation Discussion and Analysis, the tables and the related footnotes and narrative accompanying the tables contained in our "Executive Compensation"“Executive Compensation” section). Supporting Statement: In accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, our shareholders have the opportunity to vote to approve, on an advisory and non-binding basis, the compensation of our named executive officers.Named Executive Officers. At our 20112017 Annual Meeting of Shareholders, our shareholders elected, via an affirmative vote of a majority of all votes cast on the matter, to hold such non-binding, advisory votes on executive compensation on an annual basis, and, accordingly, we have elected to continue to annually hold an advisory vote on the compensation of our named executive officers.Named Executive Officers.

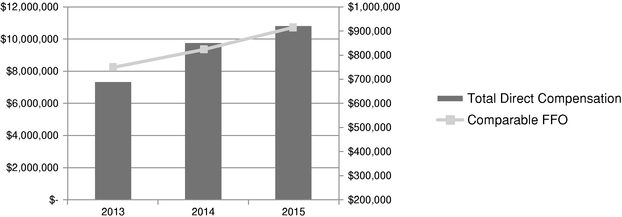

Our executive compensation programs are described in detail in this proxy statement in the section titled "Compensation“Compensation Discussion and Analysis"Analysis,” the accompanying tables and the accompanying tables.related narrative disclosure in this Proxy Statement. These programs are designed to attract and retain talented individuals who possess the skills and expertise necessary to lead Vornado.The Compensation Committee regularly assesses all elements of the compensation paidVornado and to our Named Executive Officers. In 2012, the Compensation Committee implemented a series of modifications to our compensation programs to address input received from our shareholders. A summary of our current compensation programs, inclusive of the aforementioned modifications, is presented in the Compensation Discussion and Analysis section and the accompanying tables and related narrative disclosure in this proxy statement. The Compensation Committee believes that the Company's present compensation programs promote in the best manner possible our business objectives while aligning the interests of the Named Executive Officers with our shareholders to enhance continued positive financial results. During 2015, the Company recorded strong financial results while continuing our simplification and focusing strategy, producing 10.5% growth in comparable funds from operations (per diluted share), and spinning off our strip shopping centers and malls business into Urban Edge Properties (NYSE: UE) in January 2015 and selling over $1 billionThe Compensation Committee regularly assesses all elements of non-core or non-strategic assets and purchasing approximately $850 million of high-quality assets in New York City (including approximately $700 million in Manhattan). We believe the compensation programs forpaid to our Named Executive Officers are a key ingredient in motivating our executives to continue to deliver such results.

Officers.

The results of this advisory vote are not binding on the Compensation Committee, the Company or our Board of Trustees. Nevertheless, theour Board of Trustees values input from our shareholders and will consider carefully the results of this vote when making future decisions concerning executive compensation. The Board of Trustees unanimously recommends a vote "FOR"“FOR” the non-binding, advisory resolution on executive compensation. The affirmative vote of a majority of

all the votes cast on this proposal at the Annual Meeting, assuming a quorum is present, is necessary to approve, on an advisory basis, the compensation of our Named Executive Officers. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of

thethis vote.

| | | | | | | | | | |

| | | 76 | | | | | | | | |

2016 PROXY STATEMENT | | | | VORNADO REALTY TRUST | | |

| | 2023 PROXY STATEMENT | | 59 | | |

PROPOSAL 4: NON-BINDING, ADVISORY RESOLUTION ON THE FREQUENCY OF EXECUTIVE COMPENSATION ADVISORY VOTES

In Proposal 3, shareholders are being asked to cast a non-binding, advisory vote with respect to the compensation of the Company’s executive officers named in the Summary Compensation Table. In this Proposal 4, as required by the rules and regulations of the SEC, the Board of Trustees is asking shareholders to cast a non-binding, advisory vote on how frequently such votes with respect to executive compensation should be held in the future. Shareholders will be able to cast their votes on whether to hold votes with respect to executive compensation every one, two or three years. Alternatively, you may abstain from casting a vote. This advisory vote is not binding on the Board.

Advisory Resolution on Frequency of Executive Compensation

Proposal: That the shareholders of Vornado Realty Trust recommend, by a non-binding, advisory vote, whether a non-binding, advisory shareholder vote to approve the compensation of the Company’s named executive officers should occur every one, two or three years.

Board of Trustees Statement: After careful consideration, our Board of Trustees has determined that an advisory vote on executive compensation that occurs every year is the most appropriate for our Company.

The Board of Trustees unanimously recommends a vote for the option of “1 YEAR” as the frequency with which shareholders are provided a non-binding, advisory vote on executive compensation.

The option of one, two or three years receiving the affirmative vote of a majority of all the votes cast on this proposal at the Annual Meeting, assuming a quorum is present, will be considered the frequency recommended by shareholders. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote. Shareholder approval of this proposal is not binding upon the Board of Trustees. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of this vote.

| | | VORNADO REALTY TRUST | | | | 77 | | |

PROPOSAL 5: APPROVAL OF THE COMPANY’S 2023 OMNIBUS SHARE PLAN

The Board of Trustees is asking the Company’s shareholders to approve the 2023 Omnibus Share Plan of Vornado Realty Trust (the “2023 Omnibus Share Plan” or the “2023 Plan”). The 2023 Omnibus Share Plan is intended to supersede and replace the Company’s 2019 Omnibus Share Plan (the “2019 Plan”) that is currently in effect. If the 2023 Plan is approved, upon such approval, no additional awards will be made under the 2019 Plan, but the terms and conditions of any outstanding awards granted under the 2019 Plan will not be affected. If the 2023 Plan is not approved by shareholders, no awards will be made under the 2023 Plan, the 2023 Plan will be null and void in its entirety, and the 2019 Plan will remain in full force and effect in accordance with its terms and conditions.

The Board of Trustees has determined that it is in the best interests of the Company to adopt the 2023 Plan, which was unanimously approved by the Board on February 9, 2023. Including the number of Shares remaining available under the 2019 Plan as of April 5, 2023, which was approximately 2.8 million full value Shares, the 2023 Plan provides for the issuance of equity-based awards covering up to 10,800,000 Shares if all awards were full value awards (restricted stock and full value restricted units) or 21,600,000 Shares if all awards were not full value awards (awards that require the grantee to pay an exercise or conversion price or otherwise do not deliver the full value of the underlying Share or underlying OP Unit).

The Board of Trustees believes that the maximum of 10,800,000 full value Share awards that would be available for grant under the 2023 Plan would provide sufficient Shares for equity-based compensation needs of the Company from May 2023 through the 2027 annual shareholder meeting, subject to headcount growth and any unexpected factors. This estimate is based on our recent usage of equity-based awards and growth estimates and is adjusted upward to allow for any one-time performance-based awards that the Board or Compensation Committee may determine to grant in the future to retain and incentivize Company employees, the potential that performance-based awards may be earned above target goals and for flexibility around the types of equity-based awards that may be used. The Company may determine to utilize a substantial portion of Shares available under the 2023 Plan (if adopted by Shareholders), to make one-time grants to certain Company employees, including non-NEOs, for retention purposes and in order to align such employees’ with shareholder returns. While the Compensation Committee has not made any determinations regarding the size or structure of any such awards, and the Compensation Committee may determine not to grant such awards, our current expectation is that awards will be comprised of a mix of time-based and performance-based awards (including tied to operational performance) and a large portion will be performance-based awards that will be linked to total shareholder returns. The actual structure of any awards could be materially different from the description above.

As of April 5, 2023, approximately 2.8 million full value Shares remained available for issuance under the 2019 Plan, which, based on the analysis above and our “burn rate” discussed below and retention considerations, we believe to be sufficient to continue our current grant practices for no more than approximately one year. Running out of capacity to grant additional equity-based compensation, could have significant negative consequences and could, among other things, inhibit our ability to align employees’ interests with those of shareholders through equity-based compensation and impede our ability to attract and retain talent.

Therefore, the Board of Trustees urges you to vote to approve the 2023 Plan.

| | | 78 | | | | VORNADO REALTY TRUST | | |

Features of the 2023 Omnibus Share Plan

•

No Evergreen or Liberal Share Recycling Provisions. The 2023 Plan does not contain an evergreen provision and authorizes a fixed number of Shares available for grant. Shares tendered by a participant or withheld by the Company in payment of the exercise price or consideration required to be paid, or to satisfy any tax withholding obligation, with respect to an award are not available for future awards.

•

No Discounted Awards or Repricings The exercise price per Share of options and stock appreciation rights may not be less than the fair market value of a Share on the grant date and options and stock appreciation rights may not be repriced without shareholder approval.

•

Clawback, Equity Ownership and Anti-Hedging Policies. Awards under the 2023 Plan will be subject to our policies, including our clawback policy, equity ownership guidelines and anti-hedging policy.

•

One-year Minimum Vesting for all Award Types. Subject to acceleration of vesting for certain events and for certain grants to retirement eligible employees to the extent permitted under the 2023 Plan, awards are subject to a minimum of one-year vesting with a limited exception that up to five percent of available Shares may be subject to awards without this minimum vesting period.

Burn Rate and Overhang

The Company’s historical share usage under its equity compensation plans (sometimes referred to as “burn rate”) and the potential dilution of the Company’s shareholders that could occur as a result of the Company’s equity plans (sometimes referred to as “overhang”) are summarized below.

Burn Rate. The following table sets forth information regarding awards granted and earned, the “burn rate” for each of the last three fiscal years and the average burn rate over the last three years.

| | | | 2020 | | | 2021 | | | 2022 | | | Average | |

(a)

Time-based restricted stock/units granted(1) | | | | | 546,600 | | | | | | 816,019 | | | | | | 501,169 | | | | | | 621,263 | | |

(b)

Performance-based Units earned in the respective years | | | | | — | | | | | | — | | | | | | —(3) | | | | | | — | | |

(c)

Options/AO LTIP Units granted to employees(1) | | | | | 206,753 | | | | | | — | | | | | | — | | | | | | 68,918 | | |

(d)

Net increase in diluted shares due to equity awards (a+b+c)(1) | | | | | 753,353 | | | | | | 816,019 | | | | | | 501,169 | | | | | | 690,180 | | |

(e)

Weighted-average shares outstanding | | | | | 191,146,220 | | | | | | 191,551,085 | | | | | | 191,774,873 | | | | | | 191,490,726 | | |

(f)

Burn rate (d/e)(2) | | | | | 0.39% | | | | | | 0.43% | | | | | | 0.26% | | | | | | 0.36% | | |

(1)

Reflects the gross maximum number of Shares underlying awards granted during the respective year.

(2)

Not adjusted for forfeitures, withholding and expirations, which would reduce the burn rate if taken into account.

(3)

In April 2023, the Compensation Committee determined that 102,366 LTPP Units were initially earned with respect to the operational component of the 2022 LTPP. These units are not reflected in the table above.

| | | VORNADO REALTY TRUST | | | | 79 | | |

Share Overhang. Based on the calculations set forth below, the total potential dilution or “overhang” resulting from the 10.8 million shares that would be available for grant following adoption of the 2023 Plan, would be 5.63% based on our basic Shares outstanding, or 5.23% based on the diluted Shares outstanding, as of April 5, 2023. Taking into account Shares underlying outstanding awards under the 2010 and 2019 Omnibus Share Plans, the dilution rate would be 8.79% or 8.16% on a basic and diluted basis, respectively.

We believe that shareholders should evaluate the “share overhang” or dilution rate, based on the number of Shares available under the 2023 plan (as calculated in rows (i) and (j) below) without taking into account the Shares underlying outstanding awards under the 2010 and 2019 Omnibus Share Plans because such awards are already outstanding regardless of adoption of the 2023 Plan.

In addition, we believe that shareholders should evaluate the “share overhang” or dilution rate, as set forth in the table below, using 10,800,000 shares available under the 2023 Plan (row (a)) which represents the maximum amount of Full-Value shares that would be available under the 2023 Plan, rather than using the 21,600,000 number of options that are available under the 2023 Plan (representing two times the amount of full-value shares available) given that option awards require the holder to pay an exercise to the Company based on the grant date Share price.

| | (a) | | | Shares available under the 2023 Plan | | | | | 10,800,000 | | |

| | (b) | | | Shares underlying outstanding awards under the 2010 and 2019 Omnibus Share

Plans(1) | | | | | 6,070,183 | | |

| | (c) | | | Shares remaining available under the 2010 and 2019 Omnibus Share Plans (upon

adoption of the 2023 Omnibus Share Plan) | | | | | — | | |

| | (d) | | | Total Shares authorized for or outstanding under equity awards (a+b+c) | | | | | 16,870,189 | | |

| | (e) | | | Common shares outstanding | | | | | 191,880,615 | | |

| | (f) | | | Diluted Shares outstanding | | | | | 206,698,025 | | |

| | (g) | | | Overhang of Total Shares authorized for or outstanding under equity awards per basic

common shares outstanding (d/e) | | | | | 8.79% | | |

| | (h) | | | Overhang per diluted common shares outstanding (d/f) | | | | | 8.16% | | |

| | (i) | | | Overhang of Shares available under the 2023 Plan per basic common shares

outstanding (a/e) | | | | | 5.63% | | |

| | (j) | | | Overhang of Shares available under the 2023 Plan per diluted common shares

outstanding (a/f) | | | | | 5.23% | | |

(1)

Shares underlying outstanding awards include 367,374 stock options and AO LTIP Units. The weighted average strike price for these awards is $64.22 and the average remaining term is 5.15 years. In addition, there are awards of 5,702,809 shares and units outstanding, of which 2,140,276 are performance-based awards.

| | | 80 | | | | VORNADO REALTY TRUST | | |

SUMMARY OF THE 2023 OMNIBUS SHARE PLAN

A copy of the full text of the 2023 Plan is attached as Annex A to this proxy statement and the summary below of the 2023 Plan is qualified in its entirety by reference to the text of the 2023 Plan. For additional information regarding equity-based compensation granted to our Named Executive Officers in 2022, see “Compensation Discussion and Analysis.”

Purpose

The purpose of the 2023 Plan is to promote the interests of the Company by encouraging its employees and the employees of its subsidiaries, including officers (together, the “Employees”), its non-employee trustees and non-employee directors of its subsidiaries (together, the “Non-Employee Trustees) and certain non-employee advisors and consultants that provide bona fide services to the Company or its subsidiaries (together, the “Consultants”) to acquire an ownership position in the Company, enhancing its ability to attract and retain Employees, Non-Employee Trustees and Consultants of outstanding ability and providing such Employees, Non-Employee Trustees and Consultants with a way to acquire or increase their proprietary interest in the Company’s success and to further align the interests of Employees, Non-Employee Trustees and Consultants with shareholders.

Overview

Under the 2023 Plan, eligible participants may be granted awards of stock options, stock appreciation rights, performance shares, restricted stock, other stock-based awards (including the grant or offer for sale of unrestricted Shares) and limited partnership units (“OP Units”) of Vornado Realty L.P. (or any successor entity), the entity through which the Company conducts substantially all its business (including appreciation-only OP Units). Awards of performance shares, restricted stock and other stock-based awards may provide the holder with dividends or dividend equivalents and voting rights prior to vesting. If dividends or dividend equivalents are granted, dividend and dividend equivalents will be paid to the holder at the same time as the Company pays dividends to holders of the Company’s Shares but not less than annually. Notwithstanding the foregoing, a holder’s right to dividends and dividend equivalent payments in the case of an award that is subject to performance-based conditions will be treated as unvested so long as the performance conditions have not been met, and any such dividend equivalent payments that would otherwise have been paid during the performance period will instead be accumulated and paid within 30 days following the date on which such award is determined by the Company to have been earned.

Shares Available for Grant under the 2023 Plan

Subject to adjustment as described below, awards may be granted under the 2023 Plan with respect to a maximum of 10,800,000 Share Equivalents (as defined below), which, in accordance with the share counting provisions of the 2023 Plan, would result in the issuance of up to a maximum of 10,800,000 Shares if all awards granted under the 2023 Plan were Full Value Awards (as defined below) and 21,600,000 Shares if all of the awards granted under the 2023 Plan were Not Full Value Awards (as defined below) (which includes approximately 2.8 million Shares remaining under the 2019 Plan on April 5, 2023). “Share Equivalents” are the measuring unit for determining the number of Shares that may be subject to awards.

The 2023 Plan is commonly referred to as a fungible unit plan. Restricted shares, restricted units or other securities that have a value equivalent to a full Share are referred to as “Full Value Awards.” Securities such as options, appreciation-only OP Units or stock appreciation rights that require the grantee to pay an exercise or conversion price or otherwise do not deliver the full value of the underlying Share or underlying OP Unit due to the deduction of a strike price are referred to as “Not Full Value Awards.” When a grant is made under the 2023 Plan, we will reduce the number of Share Equivalents available under the 2023 Plan (1) one Share Equivalent for each Share awarded pursuant to an award that is a Full Value Award and (2) one-half a Share Equivalent for each Share awarded pursuant to an award that is a Not Full Value Award, such that a Share underlying a Full Value Award reduces the number of Share Equivalents available under the 2023 Plan by double the number that a Share underlying a Non-Full Value Award would. This means, for instance, if we were to award only restricted shares under the 2023 Plan, we could award 10,800,000 restricted shares. On the other hand, if we were to award only options under the 2023 Plan, we could award options to purchase 21,600,000 Shares (at the applicable exercise price). We also could issue any combination of the foregoing (or of other securities available under the 2023 Plan) with the reductions in availability to be made in accordance with the foregoing ratios.

| | | VORNADO REALTY TRUST | | | | 81 | | |

If any award granted under the 2023 Plan expires or is forfeited, terminated or cancelled, or is paid in cash in lieu of Shares, then the Shares underlying any such award will again become available for grant under the 2023 Plan in an amount equal to one Share Equivalent for each Share that is subject to a Full Value Award and by one-half Share Equivalent for each Share that is subject to an award that is a Not Full Value Award, in each case, at the time such award expires or is forfeited, terminated or cancelled. Awards that are settled in cash do not affect the number of Share Equivalents available for awards under the 2023 Plan to the extent paid or settled in cash.

The number of Share Equivalents available under the 2023 Plan will be reduced (1) upon the exercise of a stock option, appreciation-only OP Unit or a stock appreciation right by one-half of the gross number of Shares for which the award is exercised even if the award is exercised by means of a net-settlement exercise procedure or if Shares are withheld to satisfy any tax withholding obligation and (2) by one Share for each Share withheld to satisfy any tax withholding obligation with respect to any Full Value Award. Awards issued or assumed under the 2023 Plan in connection with any merger, consolidation, acquisition of property or stock, reorganization or similar transaction will not count against the number of Share Equivalents that may be granted under the 2023 Plan.

No more than 21,600,000 Shares (subject to adjustment as described below) may be issued upon the exercise of “incentive stock options” (within the meaning of Section 422 of the Internal Revenue Code) granted under the 2023 Plan.

Shares issued under the 2023 Plan would be authorized and unissued Shares. The fair market value of one Share on March 20, 2023 was $14.61 per Share (the average of the high and low market price on the New York Stock Exchange on that date).

Estimate of Benefits

Because awards under the 2023 Plan are made on a discretionary basis by the Board or Compensation Committee, it is not possible to determine the benefits that will be received by our executive officers and other key employees. Information on our most recent equity awards is set forth under “Compensation Discussion and Analysis,” “Executive Compensation” and “New Plan Benefits.”

Adjustment of and Changes in Shares

In the event of any change in the outstanding Shares by reason of any share dividend or split, reverse split, reclassification, recapitalization, merger, consolidation, spinoff, combination or exchange of Shares or other corporate change, or any distributions to shareholders other than regular cash dividends (including, without limitation, a distribution of common or preferred shares of beneficial interest of the Trust), the Compensation Committee will make such substitution or adjustment, if any, as it deems equitable to (1) the kinds of common shares, preferred shares or other securities, and the number of Share Equivalents, for which awards may be granted under the 2023 Plan, (2) the number and kinds of Shares or other securities issued or reserved for issuance pursuant to outstanding awards and (3) the number and kinds of Shares or other common shares that can be issued through incentive stock options.

Administration

The 2023 Plan will be administered and interpreted by the Compensation Committee. The Compensation Committee is authorized to select Employees, Non-Employee Trustees and Consultants to receive awards, determine the type of awards to be made, determine the number of equity-based securities subject to any award and the other terms and conditions of such awards. Our Board of Trustees, in its sole discretion, also may grant awards or administer the 2023 Plan.

Eligibility

As of December 31, 2022, 560 Employees, 9 Non-Employee Trustees and 4 Consultants would have been eligible to participate in and receive awards under the 2023 Plan, if it had been adopted and effective at such time.

Transfer Restrictions

Awards are not assignable or transferable except by will or the laws of descent and distribution and no right or interest of any holder may be subject to any lien, obligation or liability of the holder. The Compensation Committee

| | | 82 | | | | VORNADO REALTY TRUST | | |

may determine, at the time of grant or thereafter, that an award (other than stock options intended to be incentive stock options within the meaning of Section 422 of the Internal Revenue Code) is transferable by a holder to such holder’s immediate family members (or trusts, partnerships or limited liability companies established for such immediate family members).

Clawback/Recoupment

Awards granted under the 2023 Plan will be subject to the requirement that the awards be forfeited or repaid to the Company after they have been distributed to the participant (i) to the extent set forth in an award agreement or (ii) to the extent covered by any clawback or recapture policy adopted by the Company from time to time, or any applicable laws that impose mandatory forfeiture or recoupment, under circumstances set forth in such applicable laws.

Term; Amendment and Termination

The 2023 Plan has a term through May 18, 2033, but any award granted prior to such date, and the Compensation Committee’s authority to administer the terms of such awards, will remain in effect until the award is settled or lapses. The 2023 Plan will be effective, subject to its approval by the shareholders, as of the date of the approval by the requisite number of shareholders of the Trust at the 2023 Annual Meeting. The Compensation Committee may amend or terminate the 2023 Plan or any portion of the 2023 Plan at any time, except that no amendment may be made without shareholder approval if such amendment (i) would increase the maximum aggregate number of Shares that may be issued under the 2023 Plan, (ii) would materially expand the class of service providers eligible to participate in the 2023 Plan, (iii) would result in a material increase in the benefits accrued to participants under the 2023 Plan, (iv) would reduce the exercise or conversion price of outstanding stock options or stock appreciation rights or cancel outstanding stock options or stock appreciation rights in exchange for cash, other awards or stock options or stock appreciation rights with an exercise or conversion price that is less than the exercise or conversion price of the original stock options or stock appreciation rights or (v) requires shareholder approval to comply with any applicable laws, regulations or rules, including the rules of a securities exchange or self-regulatory agency. If there is a change in applicable tax law such that OP Units become taxable to the holder of such OP Units as ordinary income, the Operating Partnership, at any time in the sole discretion of the Company or the general partner of the Operating Partnership, may cause the OP Units to be restructured and/or substituted for other awards in a way that permits a tax deduction to the Operating Partnership or the Company while preserving substantially similar pre-tax economics to the holder of such OP Units.

Types of Awards

Operating Partnership Units

OP Units are valued by reference to the value of the underlying Shares to which such award relates. The employment conditions, the length of the period for vesting and other applicable conditions and restrictions of OP Unit awards, including computation of financial metrics and/or achievement of pre-established performance goals, are established by the Compensation Committee. Such OP Unit awards may provide the holder with dividend-equivalent rights prior to vesting.

Appreciation-Only OP Units (or AO LTIP Units).

“AO LTIP Units” are a class of OP Units that are intended to produce for holders a substantially similar non-tax economic effect as that of options. Each AO LTIP Unit is potentially convertible into Class A OP Units (each one of which is ultimately redeemable for one Share or cash at the option of the Company). Each AO LTIP Unit will be issued under the 2023 Plan and may be convertible for up to a period of 10 years from the date of grant. The employment conditions, the length of the period for vesting and other applicable conditions and restrictions of AO LTIP Unit awards, including computation of financial metrics and/or achievement of pre-established performance goals, are established by the Compensation Committee. On the date of grant, each AO LTIP Unit is awarded with a specified conversion price. That conversion price will never be lower (and may be significantly higher) than the price for one Share on the date of grant. Each AO LTIP Unit, on conversion, will be converted into such number of Class A OP Units that has a value equal to the excess of the closing price per Share on the date of conversion on the New York Stock Exchange over the specified conversion price. After a required two-year

| | | VORNADO REALTY TRUST | | | | 83 | | |

holding period, those Class A OP Units, in turn, may be redeemable for Shares. Such AO LTIP Unit awards may provide the holder with dividend-equivalent rights prior to vesting.

Stock Options

Stock options entitle the holder to purchase the Company’s Shares at a per Share price determined by the Compensation Committee, which in no event may be less than the fair market value of the Shares on the date of grant. Options may be either “incentive stock options” within the meaning of Section 422 of the Internal Revenue Code or “non-qualified” stock options.

Stock options are exercisable for such period as is determined by the Compensation Committee, but in no event may options be exercisable after 10 years from the date of grant. The option price for Shares purchased upon the exercise of an option must be paid in full at the time of exercise and may be paid in cash, by tender of Shares, by such other consideration as the Compensation Committee deems appropriate or by a combination of cash, Shares and such other consideration. Like the 2019 Plan, the 2023 Plan does not provide for the grant of “reload stock options” (meaning, if a grantee were to pay the applicable exercise in Shares already owned, the grantee would automatically be granted a new option in the amount of the surrendered Shares).

Stock Appreciation Rights

Stock appreciation rights entitle the holder to receive from the Company an amount equal to the amount by which the fair market value of a Share on the date of exercise exceeds the grant price. The Compensation Committee will establish the grant price, which may not be less than the fair market value of the Shares on the date of grant and the term, which will not be more than 10 years from the date of grant. Stock appreciation rights may be granted in tandem with a stock option or in addition to a stock option or may be freestanding and unrelated to a stock option. The Compensation Committee is authorized to determine whether a stock appreciation right will be settled in cash, Shares or a combination thereof. Stock appreciation rights settled in cash will not reduce the number of Shares issuable under the 2023 Plan.

Performance Shares

Performance share awards consist of a grant of actual Shares or Share units having a value equal to an identical number of the Company’s Shares in amounts determined by the Compensation Committee at the time of grant. Performance share awards consisting of actual Shares entitle the holder to receive Shares in an amount based upon performance conditions of the Company over a performance period as determined by the Compensation Committee at the time of grant. Such performance share awards may provide the holder with dividends and voting rights prior to vesting, subject to dividend accumulation until vested as described above. Performance share awards consisting of Share units entitle the holder to receive the value of such units in cash, Shares or a combination thereof based upon performance conditions and over a performance period as determined by the Compensation Committee at the time of grant.

Restricted Shares

Restricted share awards consist of a grant of actual Shares or Share units having a value equal to an identical number of Shares of the Company. Restricted share awards consisting of actual Shares entitle the holder to receive Shares of the Company. Such restricted share awards may provide the holder with dividends and voting rights prior to vesting. Restricted share awards consisting of Share units entitle the holder to receive the value of such units in cash, Shares or a combination thereof as determined by the Compensation Committee and may provide the holder with dividends. The employment or other conditions and the length of the period for vesting of restricted share awards are established by the Compensation Committee at the time of grant.

Other Stock-Based Awards

Other types of equity-based or equity-related awards, including the grant or offer for sale of unrestricted Shares, may be granted under such terms and conditions as may be determined by the Compensation Committee.

Vesting

The Compensation Committee will determine the time or times at which awards become vested, unrestricted or may be exercised, subject to the following limitations. Subject to accelerated vesting upon certain events that may

| | | 84 | | | | VORNADO REALTY TRUST | | |

be specified in an award agreement, including upon an involuntary termination of employment or service, the occurrence of a change in control or a grantee’s retirement, disability, hardship or death, (i) awards that are not Full Value Awards will not vest or be exercisable earlier than the first anniversary of the date on which such award is granted, (ii) time-based vesting awards of Full Value Awards will be subject to a minimum one-year vesting period and (iii) performance-based vesting awards of Full Value Awards will have a performance period that ends no earlier than the first anniversary of the commencement of the period over which performance is evaluated. Notwithstanding the foregoing, (x) a maximum of 5% of the maximum aggregate number of Share Equivalents available under the 2023 Plan in respect of awards and (y) Share Equivalents granted to retirement eligible grantees can be subject to awards without regard to the minimum vesting limits in the preceding sentence.

Change in Control

In the event of a change in control (as defined in the 2023 Plan), the Compensation Committee may take one or more of the following actions with respect to outstanding awards, in its sole discretion: (i) settle awards for an amount of cash or securities, where in the case of stock options and stock appreciation rights, the value of such amount, if any, will be equal to the in-the-money spread value of such awards; (ii) provide for the assumption of or the issuance of substitute awards; (iii) modify the terms of such awards to add events, conditions or circumstances upon which the vesting of such awards or lapse of restrictions thereon will accelerate; (iv) deem any performance conditions satisfied or provide for the performance conditions to continue (in accordance with their terms or as adjusted by the Compensation Committee) after the change in control or (v) provide that for a period of at least 20 days prior to the change in control, any stock options or stock appreciation rights that would not otherwise become exercisable prior to the change in control will be exercisable as to all Shares subject thereto (but any such exercise will be contingent upon and subject to the occurrence of the change in control) and that any stock options or stock appreciation rights not exercised prior to the consummation of the change in control will terminate.

Material U.S. Federal Income Tax Consequences of Awards

Below is a brief summary of the principal U.S. federal income tax consequences of awards under the 2023 Plan under current law. This summary is not intended to be exhaustive and does not describe, among other things, state, local or foreign income, withholding and payroll tax matters, and other tax consequences. The specific tax consequences to a participant will depend on that participant’s individual circumstances.

Incentive Stock Options. Upon the grant or exercise of an incentive stock option, no income will be recognized by the optionee for federal income tax purposes (except as otherwise noted below with respect to the alterative minimum tax), and the Company will not be entitled to any deduction. If the Shares acquired upon exercise are not disposed of within the one-year period beginning on the date of the transfer of the Shares to the optionee, nor within the two-year period beginning on the date of the grant of the option, any gain or loss realized by the optionee upon the disposition of such Shares will be taxed as long-term capital gain or loss. In such event, no deduction will be allowed to the Company. If such Shares are disposed of within the periods referred to above, the excess of the fair market value of the Shares on the date of exercise (or, if less, the fair market value on the date of disposition, if the disposition is a sale or exchange with respect to which a loss, if sustained, would be recognized by the optionee) over the exercise price will be taxable as ordinary income to the optionee at the time of disposition, and the Company generally will be entitled to a corresponding deduction. The amount by which the fair market value of the Shares at the time of exercise of an incentive stock option exceeds the option price will constitute an item of tax preference that could subject the optionee to the alternative minimum tax. Whether the optionee will be subject to such tax depends on the facts and circumstances applicable to the individual.

Non-Qualified Stock Options. Upon the grant of a non-qualified stock option, no income will be realized by the optionee, and the Company will not be entitled to any deduction. Upon the exercise of such an option, the amount by which the fair market value of the Shares at the time of exercise exceeds the exercise price will be taxed as ordinary income to the optionee, and the Company generally will be entitled to a corresponding deduction. All option grants to Non-Employee Trustees and Consultants are treated as non-qualified options for federal income tax purposes.

Stock Appreciation Rights. Upon the grant of a stock appreciation right, no taxable income will be realized by the holder, and the Company will not be entitled to any tax deduction. Upon the exercise of a stock appreciation right, the amount by which the fair market value of the Shares at the time of exercise exceeds the grant price will be taxed as ordinary income to the holder, and the Company generally will be entitled to a corresponding deduction.

| | | VORNADO REALTY TRUST | | | | 85 | | |

Performance Shares and Restricted Shares. A participant will not be subject to tax upon the grant of a restricted share unit, or upon the grant of actual restricted Shares, unless such participant makes the election referred to below with respect to restricted Shares. Upon the vesting date (the date of lapse of the applicable forfeiture conditions or transfer restrictions, in the case of Share awards and, in the case of unit awards, the date of vesting and distribution of the Shares and/or cash underlying the units), the participant will recognize ordinary income equal to the fair market value of the Shares and/or cash received (less any amount such participant may have paid for the Shares), and the Company generally will be entitled to a deduction equal to the amount of income recognized by such participant. In the case of an award of actual restricted Shares, if any dividends are paid on such common shares prior to the vesting date, they will be includible in a participant’s income during the restricted period as additional compensation (and not as dividend income).

A participant may elect to recognize immediately, as ordinary income, the fair market value of restricted Shares (less any amount paid for the Shares) on the date of grant, without regard to applicable forfeiture conditions and transfer restrictions. This election is referred to as a Section 83(b) election. If a participant makes this election, the holding period will begin the day after the date of grant, dividends paid on the Shares will be subject to the normal rules regarding distributions on stock and no additional income will be recognized by such participant upon the vesting date. However, if a participant forfeits the restricted Shares before the vesting date, no deduction or capital loss will be available to that participant in excess of any amount paid for the Shares (even though the participant previously recognized income with respect to such forfeited Shares). In the event that the Shares are forfeited by such participant, the Company generally will include in its income the amount of its original deduction.

OP Units. OP Unit awards (including AO LTIP Unit awards) are intended to be structured to qualify as “profits interests” for federal income tax purposes, meaning that, under current law, no income will be recognized by the recipient upon grant or vesting, and the Company will not be entitled to any deduction. If OP Units are not disposed of within the three-year period beginning on the date of grant of the OP Unit award, any gain realized by the recipient upon disposition will generally be taxed as long-term capital gain (assuming the applicable tax elections are made by the grantee in connection with the grant of the award).

Disposition of Shares. Unless stated otherwise above, upon the subsequent disposition of Shares acquired under any of the preceding awards, the participant will recognize capital gain or loss based upon the difference between the amount realized on such disposition and the participant’s basis in the Shares, and such amount will be long term capital gain or loss if such Shares were held for more than 12 months.

Additional Tax on Net Investment Income. Participants are subject to a 3.8% tax on the lesser of (i) the participant’s “net investment income” for the relevant taxable year and (ii) the excess of the participant’s modified adjusted gross income for the taxable year over a certain threshold (between $125,000 and $250,000, depending on the participant’s circumstances). A participant’s net investment income generally includes dividend income and net gains from the disposition of Shares. Participants are urged to consult their tax advisors regarding the applicability of this tax on net investment income to their income and gains in respect of their investment in Shares.

Section 409A. If an award is subject to Section 409A of the Code, but does not comply with the requirements of Section 409A of the Code, the taxable events as described above could apply earlier than described, and could result in the imposition of additional taxes and penalties. Participants are urged to consult with their tax advisors regarding the applicability of Section 409A of the Code to their awards.

Non-Employee Trustees. The discussion above generally applies to awards to Non-Employee Trustees; provided that Non-Employee Trustees are not eligible to receive grants of incentive stock options, and any amounts taxable to Non-Employee Trustees in respect of awards are not subject to Federal Insurance Contributions Act (“FICA”) taxes (but may instead be subject to certain self-employment taxes). Generally, cash-based awards, including retainers and fees, will be taxable to the recipient as ordinary income at the time paid.

| | | 86 | | | | VORNADO REALTY TRUST | | |

New Plan Benefits

No awards will be granted under the 2023 Plan prior to its approval by our shareholders. Awards under the 2023 Plan will be granted at the discretion of the Compensation Committee. As a result, it is not possible to determine the number or type of awards that will be granted to any person under the 2023 Plan. The awards granted in 2023 (for 2022 performance) under the 2019 Plan, which would not have changed if the 2023 Plan had been in place instead of the 2019 Plan, are set forth in the table below.

| Name and Position | | | Dollar Value ($)(1) | | | 2019 Omnibus

Share Plan

Number of

Shares and

Units | |

| Steven Roth | | | 11,167,928 | | | 501,366 | |

| Michael J. Franco | | | 3,420,304 | | | 153,549 | |

| Haim Chera | | | 1,091,675 | | | 49,009 | |

| Glen J. Weiss | | | 3,169,666 | | | 142,297 | |

| Barry S. Langer | | | 2,749,203 | | | 123,421 | |

| Current executive officers as a group (includes NEOs) | | | 22,488,261 | | | 1,009,574 | |

| Employees other than executive officers as a group | | | 1,965,947 | | | 88,258 | |

(1)

Dollar value reflects the number of units issued multiplied by the average of the high and low Share price on the date of grant and does not apply a fair value discount and accordingly results in a higher value than the Grant Date Fair Value of such awards.

The Board of Trustees unanimously recommends a vote “FOR” the approval of the Company’s 2023 Omnibus Share Plan.

The affirmative vote of holders of a majority of the votes cast on this proposal at the Annual Meeting, assuming a quorum is present, is necessary to approve the 2023 Plan. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of this vote.

| | | VORNADO REALTY TRUST | | | | 87 | | |

INCORPORATION BY REFERENCE To the extent this proxy statement is incorporated by reference into any other filing by the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act, of 1934, the sections entitled "Compensation“Compensation Committee Report on Executive Compensation"Compensation” and "Report“Report of the Audit Committee" (toCommittee” (to the extent permitted by the rules of the SEC) will not be deemed incorporated unless provided otherwise in such filing. ADDITIONAL MATTERS TO COME BEFORE THE MEETING The Board does not intend to present any other matter, nor does it have any information that any other matter will be brought, before the Annual Meeting. However, if any other matter properly comes before the Annual Meeting, it is the intention of each of the individuals named in the accompanying proxy to vote said proxy in accordance with theirhis or her discretion on such matters. PROXY AUTHORIZATION VIA THE INTERNET OR BY TELEPHONE We have established procedures by which shareholders may authorize their proxies via the Internet or by telephone. You may also authorize your proxy by mail. Please see the proxy card or voting instruction form accompanying this proxy statement for specific instructions on how to authorize your proxy by any of these methods. Proxies authorized via the Internet or by telephone must be received by 11:59 P.M., New York City time, on Wednesday, May 18, 2016.17, 2023. Authorizing your proxy via the Internet or by telephone will not affect your right to revoke your proxy should you decide to do so. The Internet and telephone proxy authorization procedures are designed to authenticate shareholders'shareholders’ identities, to allow shareholders to give their voting instructions and to confirm that shareholders'shareholders’ instructions have been recorded properly. The Company has been advised that the Internet and telephone proxy authorization procedures that have been made available are consistent with the requirements of applicable law. Shareholders authorizing their proxies via the Internet or by telephone should understand that there may be costs associated with voting in these manners, such as charges forfrom Internet access providers and telephone companies, that must be borne by the shareholder. HOUSEHOLDING OF ANNUAL MEETING MATERIALS

Some banks, brokers, broker-dealers and other similar organizations acting as nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of this proxy statement may have been sent to multiple shareholders in your household. If you would prefer to receive separate copies of a proxy statement or annual report for other shareholders in your household, either now or in the future, please contact your bank, broker, broker-dealer or other similar organization serving as your nominee. Upon written or oral request to the Company at 888 Seventh Avenue, New York, New York 10019, or via telephone at 212-894-7000, the Company will provide separate copies of the annual report and/or this proxy statement. If a shareholder receives multiple copies of the annual report and/or this proxy statement, he or she may request householding in the future by contacting the Company at 888 Seventh Avenue, New York, New York 10019 or calling 212-894-7000.

ADVANCE NOTICE FOR SHAREHOLDER NOMINATIONS AND SHAREHOLDER PROPOSALS The Bylaws of the Company currently provide that in order for a shareholder to nominate a candidate for election as a Trustee at an Annual Meeting of Shareholders outside of the proxy access provision in the Bylaws described below or propose business for consideration at such meeting (other than a proposal for inclusion in the proxy statement for the Company’s Annual Meeting of Shareholders in 2024 pursuant to Rule 14a-8 under the Securities

| | | 88 | | | | VORNADO REALTY TRUST | | |

Exchange Act), notice must be given to the Secretary of the Company no more than 120150 days nor less than 90120 days prior to the first anniversary of the date of the proxy statement of the preceding year'syear’s Annual Meeting and must include certain information specified in the Bylaws. As a result, any notice given by or on behalf of a shareholder pursuant to the provisions of our current Bylaws (other than the proxy access provision) must comply with the requirements of the Bylaws and must be delivered to the Secretary of the Company at the principal executive office of the Company, 888 Seventh Avenue, New York, New York 10019, betweennot earlier than November 9, 2023, and including January 19, 2017not later than the close of business on December 9, 2023.

Shareholders providing notice to the Company under the SEC’s rule 14a-19 who intend to solicit proxies in support of nominees other than the Company’s nominees for the 2024 Annual Meeting must comply with the above deadlines, the requirements of our Bylaws and February 18, 2017. any additional requirements of Rule 14a-19(b).

Shareholders who wish to submit a “proxy access” nomination for inclusion in our proxy statement in connection with our 2023 Annual Meeting of Shareholders must submit a written notice in compliance with the procedures and along with the other information required by our current Bylaws to the Secretary of the Company at the principal executive office of the Company, 888 Seventh Avenue, New York, New York 10019, not earlier than November 9, 2023, and not later than December 9, 2023.

The Board of Trustees may amend the Bylaws from time to time. Shareholders interested in presenting a proposal for inclusion in the proxy statement for the Company'sCompany’s Annual Meeting of Shareholders in 20172024 may do so by following the procedures in Rule 14a-8 under the Securities Exchange Act of 1934.Act. To be eligible for inclusion, shareholder proposals must be received at the

| | | | | | | | | | |

| | | | | | | | | | |

| | 60 | | | | VORNADO REALTY TRUST | | | | 2016 PROXY STATEMENT |

| | | | | | | | | | |

principal executive office of the Company, 888 Seventh Avenue, New York, New York 10019, Attention: Secretary, not later than the close of business on December 9, 2016.

| | |

| | By Order of the Board of Trustees, |

| | Alan J. Rice

Secretary

|

| | New York, New York

April 8, 2016

|

By Order of the Board of Trustees,Steven J. Borenstein

Secretary

New York, New York

April 7, 2023

It is important that proxies be returned promptly. Please authorize your proxy over the Internet, by telephone or by

requesting, executing and returning a proxy card or voting instruction form.

| | | | | | | | | | |

| | | | | | | | | | | |

2016 PROXY STATEMENT | | | | VORNADO REALTY TRUST | | | | 6189 | | |

ANNEX A

Vornado Realty Trust

2023 Omnibus Share Plan

(Subject to approval by shareholders on May 18, 2023)

ANNEX A

CORPORATE GOVERNANCE GUIDELINES

I. Introduction

The Board of Trustees (the "Board") of Vornado Realty Trust (the "Trust"), acting on the recommendation of its Corporate Governance and Nominating Committee, has developed and adopted a set of corporate governance principles (the "Guidelines") to promote the functioning of the Board and its committees and to set forth a common set of expectations as to how the Board should perform its functions. These Guidelines are in addition to the Trust's Amended and Restated Declaration of Trust and Amended and Restated Bylaws, in each case as amended. References to the masculine, feminine or neuter gender herein shall be deemed to include the others whenever the context so indicates or requires.

II. Board Composition

The composition of the Board should balance the following goals:

nThe size of the Board should facilitate substantive discussions of the whole Board in which each Trustee can participate meaningfully;

nThe composition of the Board should encompass a broad range of skills, expertise, industry knowledge, diversity of opinion and contacts relevant to the Trust's business; and

nA majority of the Board shall consist of Trustees who the Board has determined are "independent" under the Corporate Governance Rules (the "NYSE Rules") of The New York Stock Exchange, Inc. (the "NYSE").

III. Selection of Chairman of the Board and Chief Executive Officer

The Board is free to select its Chairman and the Trust's Chief Executive Officer in the manner it considers in the best interests of the Trust at any given point in time. These positions may be filled by one individual or by two different individuals.

IV. Selection of Trustees

Nominations. The Board is responsible for selecting the nominees for election to the Board. The Corporate Governance and Nominating Committee is responsible for recommending to the Board a slate of Trustees or one or more nominees to fill vacancies occurring between annual meetings of shareholders. The Corporate Governance and Nominating Committee may, in its discretion, work or otherwise consult with members of management of the Trust in preparing the Corporate Governance and Nominating Committee's recommendations.

Criteria. The Board should, based on the recommendation of the Corporate Governance and Nominating Committee, consider new nominees for the position of independent Trustee on the basis of the following criteria:

nPersonal qualities and characteristics, accomplishments and reputation in the business community;

nCurrent knowledge and contacts in the communities in which the Trust does business and in the Trust's industry or other industries relevant to the Trust's business;

nAbility and willingness to commit adequate time to Board and committee matters;

| | | | | | | | | | |

| | | | | | | | | | |

| | 62 | | | | VORNADO REALTY TRUST | | |

| | 2023 PROXY STATEMENT | | 2016 PROXY STATEMENT |

nThe fit of the individual's skills and personality with those of other Trustees and potential Trustees in maintaining a Board that is effective, collegial and responsive to the interests of the Trust; and

nDiversity of viewpoints, experience and other demographics (including race, age and gender). The Trust is committed to including persons of diverse backgrounds in candidate pools when seeking new members of the Board. However, nomination of a candidate should not be based solely on these factors.

Independence Standards. To qualify as independent under the NYSE Rules, the Board must affirmatively determine that a Trustee has no material relationship with the Trust and/or its consolidated subsidiaries. The Board has adopted the following categorical standards to assist it in making determinations of independence. For purposes of these standards, references to the "Trust" mean Vornado Realty Trust and its consolidated subsidiaries.

The following relationships have been determined not to be material relationships that would categorically impair a Trustee's ability to qualify as independent:

1.Payments to and from other organizations. A Trustee's or his immediate family member's status as executive officer or employee of an organization that has made payments to the Trust, or that has received payments from the Trust, not in excess of the greater of:

(i)$1 million; or

(ii)2% of the other organization's consolidated gross revenues for the fiscal year in which the payments were made.

In the case where an organization has received payments that ultimately represent amounts due to the Trust and such amounts are not due in respect of property or services from the Trust, these payments will not be considered amounts paid to the Trust for purposes of determining (i) and (ii) above so long as the organization does not retain any remuneration based upon such payments.

2.Beneficial ownership of the Trust's equity securities. Beneficial ownership by a Trustee or his immediate family member of not more than 10% of the Trust's equity securities. A Trustee or his immediate family member's position as an equity owner, director, executive officer or similar position with an organization that beneficially owns not more than 10% of the Trust's equity securities.

3.Common ownership with the Trust. Beneficial ownership by, directly or indirectly, a Trustee, either individually or with other Trustees, of equity interests in an organization in which the Trust also has an equity interest.

4.Directorships with, or beneficial ownership of, other organizations. A Trustee's or his immediate family member's interest in a relationship or transaction where the interest arises from either or both of:

(i)his or his family member's position as a director with an organization doing business with the Trust; or

(ii)his or his family member's beneficial ownership in an organization doing business with the Trust so long as the level of beneficial ownership in the organization is 25% or less, or less than the Trust's beneficial ownership in such organization, whichever is greater.

5.Affiliations with charitable organizations. The affiliation of a Trustee or his immediate family member with a charitable organization that receives contributions from the Trust, or an affiliate of the Trust, so long as such contributions do not exceed for a particular fiscal year the greater of:

(i)$1 million; or

(ii)2% of the organization's consolidated gross revenues for that fiscal year.

91 | | | | | | | | | | | | | | | | | | | | | | 91 | | | 2016 PROXY STATEMENT | | | | | | 92 | | | | | | | | | | 92 | | | | | | | | | | 93 | | | | | | | | | | 93 | | | | | | | | | | 94 | | | | | | | | | | 94 | | | | | | | | | | 95 | | | | | | | | | | 95 | | | | | | | | | | 95 | | | | | | | | | | 95 | | | | | | | | | | 95 | | | | | | | | | | 96 | | | | | | | | | | 96 | | | | | | | | | | 97 | | | | | | | | | | 97 | | | | | | | | | | 97 | | | | | | | | | | 97 | | | | | | | | | | 98 | | | | | | | | | | 98 | | | | | | | | | | 98 | | |

| | | VORNADO REALTY TRUST | | | | 6391 | | |

1.

Purpose The purpose of the 2023 Omnibus Share Plan of Vornado Realty Trust (as amended from time to time, the “Plan”), is to promote the interests of Vornado Realty Trust (the “Trust”), including its growth and performance, by encouraging employees of the Trust and its subsidiaries, including officers (together, the “Employees”), its non-employee trustees of the Trust and non-employee directors of its subsidiaries (together, the “Non-Employee Trustees”) and certain non-employee advisors and consultants that provide bona fide services to the Trust or its subsidiaries (together, the “Consultants”) to acquire an ownership position in the Trust, enhancing the ability of the Trust and its subsidiaries to attract and retain Employees, Non-Employee Trustees and Consultants of outstanding ability, and providing Employees, Non-Employee Trustees and Consultants with a way to acquire or increase their proprietary interest in the Trust’s success and to further align the interests of the Employees, Non-Employee Trustees and Consultants with shareholders of the Trust. Each of the terms set forth in the Appendix is defined in the Section of the Plan set forth opposite such term. The Plan replaces the Vornado Realty Trust 2019 Omnibus Share Plan, as amended (the “Predecessor Plan”), for awards granted on or after the Effective Date (as defined in Section 22). Awards may not be granted under the Predecessor Plan beginning on the Effective Date, but the adoption and effectiveness of the Plan will not affect the terms or conditions of any outstanding grants under the Predecessor Plan prior to the Effective Date. 2.

Shares Available for Awards Subject to the provisions of this Section 2 or any adjustment as provided in Section 18, awards may be granted under the Plan with respect to 10,800,000 Share Equivalents (as defined below), which, in accordance with the share counting provisions of this Section 2, would result in the issuance of up to a maximum of 10,800,000 common shares, par value $0.04, of beneficial interest in the Trust (the “Shares”) if all awards granted under the Plan were Full Value Awards (as defined below) and 21,600,000 Shares if all awards granted under the Plan were not Full Value Awards (which includes the number of Shares remaining under the Predecessor Plan as of April 5, 2023). The Shares issued under the Plan may be authorized and unissued Shares, as the Trust may from time to time determine. Any Shares that are subject to awards that are not Full Value Awards shall be counted against the number of Share Equivalents available for the grant of awards under the Plan, as set forth in the first sentence of this Section 2, as one-half Share Equivalent for every Share granted pursuant to an award; any Shares that are subject to awards that are Full Value Awards shall be counted as one Share Equivalent for every Share granted pursuant to an award. “Share Equivalent” shall be the measuring unit for purposes of the Plan to determine the number of Shares that may be subject to awards hereunder, which number of Shares shall not in any event exceed 21,600,000, subject to the provisions of this Section 2 or any adjustment in the kind and number of securities as provided in Section 18. For the avoidance of doubt, if the Trust issues any dividend or distribution to shareholders of the Trust in the form of another equity security of the Trust during the term of this Plan, then the Share Equivalents that may be subject to awards hereunder, including as a result of an adjustment or substitution pursuant to Section 18, shall include (i) the Share Equivalents then-remaining for issuance and (ii) an amount of such other equity securities of the Trust as would have been issued as a dividend or distribution in respect of such Share Equivalents had they been outstanding. “Full Value Award” means an award under the Plan other than a stock option, stock appreciation right or other award that does not deliver on the grant date of such award the full value of the underlying Shares or underlying OP Units. “OP Units” are undivided fractional limited partnership interests in Vornado Realty L.P. (together with any successor entity, the “Operating Partnership”), of one or more classes established pursuant to the Operating Partnership’s agreement of limited partnership, as amended from time to time. The Operating Partnership is a Delaware limited partnership, the entity through which the Trust conducts its business and an entity that has elected to be treated as a partnership for federal income tax purposes. The Compensation Committee (the “Committee”) of the Board of Trustees of the Trust (the “Board of Trustees”) may, without affecting the number of Share Equivalents available pursuant to this Section 2, authorize the issuance or assumption of benefits under the Plan in connection with any merger, consolidation, acquisition of property or stock, reorganization or similar transaction upon such terms and conditions as it may deem appropriate, subject to compliance with Section 409A of the Code (“Section 409A”) and any other applicable provisions of the Internal Revenue Code of 1986, as amended (the “Code”).

6.Relationships with organizations to which the Trust owes money. A Trustee's or his immediate family member's status as an executive officer or employee of an organization to which the Trust was indebted at the end of the Trust's most recent fiscal year so long as that total amount of indebtedness is not in excess of 5% of the Trust's total consolidated assets.

7.Relationships with organizations that owe money to the Trust. A Trustee's or his immediate family member's status as an executive officer or employee of an organization which is indebted to the Trust at the end of the Trust's most recent fiscal year so long as that total amount of indebtedness is not in excess of 15% of the organization's total consolidated assets.

8.Personal indebtedness to the Trust. A Trustee's or his immediate family member's being indebted to the Trust at any time since the beginning of the Trust's most recently completed fiscal year so long as such amount does not exceed the greater of:

(i)$1 million; or

(ii)2% of the individual's net worth.

9.Leasing or retaining space from the Trust. The leasing or retaining of space from the Trust by:

(i)a Trustee;

(ii)a Trustee's immediate family member; or

(iii)an affiliate of a Trustee or an affiliate of a Trustee's immediate family member;

so long as in each case the rental rate and other lease terms are at market rates and terms in the aggregate at the time the lease is entered into or, in the case of a non-contractual renewal, at the time of the renewal.

10.Other relationships that do not involve more than $100,000. Any other relationship or transaction that is not covered by any of the categorical standards listed above and that does not involve payment of more than $100,000 in the most recently completed fiscal year of the Trust.

11.Personal relationships with management. A personal relationship between a Trustee or a Trustee's immediate family member and a member of the Trust's management.

12.Partnership and co-investment relationships between or among Trustees. A partnership or co-investment relationship between or among a Trustee or a Trustee's immediate family member and other members of the Trust's Board of Trustees, including management Trustees, so long as the existence of the relationship has been previously disclosed in the Trust's reports and/or proxy statements filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended.

The fact that a particular transaction or relationship falls within one or more of the above categorical standards does not eliminate a Trustee's obligation to disclose the transaction or relationship to the Trust, the Board of Trustees or management as and when requested for public disclosure and other relevant purposes. For relationships that are either not covered by or do not satisfy the categorical standards above, the determination of whether the relationship is material and therefore whether the Trustee qualifies as independent may be made by the Corporate Governance and Nominating Committee or the Board. The Trust shall explain in the annual meeting proxy statement immediately following any such determination the basis for any determination that a relationship was immaterial despite the fact that it did not meet the foregoing categorical standards.

Invitation. The invitation to join the Board should be extended by the Board itself via the Chairman of the Board and CEO of the Trust, together with an independent Trustee, when deemed appropriate.

| | | | | | | | | | | | | | | | | | | | | | | | 64 | | | | VORNADO REALTY TRUST | | |

| | 20162023 PROXY STATEMENT | | | | | | | | | | | |

OrientationShares subject to an award granted under the Plan that expires unexercised, that is forfeited, terminated or cancelled, in whole or in part, or is paid in cash in lieu of Shares, shall thereafter again be available for grant under the Plan; provided, however, that the number of Share Equivalents that shall again be available for the grant under the Plan shall be increased by one Share Equivalent for each Share that is subject to a Full Value Award at the time such Full Value Award expires or is forfeited, terminated or cancelled and Continuing Education. Management, workingby one-half Share Equivalent for each Share that is subject to an award that is not a Full Value Award at the time such award expires or is forfeited, terminated or cancelled. Awards that use Shares as a reference but that are paid or settled in whole or in part in cash shall not affect the number of Share Equivalents available under the Plan pursuant to this Section 2 to the extent paid or settled in cash. The number of Share Equivalents available for the purpose of awards under the Plan shall be reduced by (i) one-half of the gross number of Shares for which stock options or stock appreciation rights are exercised, regardless of whether any of the Shares underlying such awards are not actually issued as the result of a net settlement or to satisfy any tax withholding obligation and (ii) one Share for each Share withheld to satisfy any tax withholding obligation with respect to any Full Value Award, as described further in Section 15. The maximum aggregate number of Share Equivalents that may be granted under the Plan, as set forth in this Section 2, shall be cumulatively increased from time to time by the number of Shares subject to, or acquired pursuant to, that portion of any award granted under the Predecessor Plan and outstanding as of the Effective Date that, on or after the Effective Date, expires unexercised, that is forfeited, terminated or cancelled, in whole or in part, or is paid in cash in lieu of Shares; provided, however, that the number of Share Equivalents that shall again be available for grant under the Plan shall be increased by one-half Share Equivalent for each Share that is subject to an award granted under the Predecessor Plan that would not have been a Full Value Award if granted under the Plan at the time such award expires or is forfeited, terminated or cancelled. The maximum aggregate number of Shares that may be issued under the Plan pursuant to the exercise of incentive stock options within the meaning of Section 422 of the Code shall not exceed 21,600,000 Shares (as adjusted pursuant to the provisions of Section 18). 3.